Is Outbound dead in the Carbon Market, or is it you?

Estimated reading time: 9 minutes

The Declaration Heard 'Round LinkedIn

Every few weeks, a new post declares it with certainty: "Outbound sales is dead."

The evidence seems damning:

- 52% of outbound marketers call their own strategies "ineffective"

- Only 16% of marketers believe outbound generates high-quality leads

- Email open rates are plummeting as inboxes overflow with automated sequences

- Buyers are more skeptical than ever of unsolicited outreach

And yet... something doesn't add up.

Because while generic outbound struggles, companies in specialized markets, including carbon credits, are quietly booking 20-30 meetings per month through targeted outreach. Not with more emails. With better research.

The uncomfortable truth: Outbound isn't dead. Your approach is.

What's Actually Dying (And Good Riddance)

Let's be clear about what deserves to die:

1. Spray-and-Pray Volume Plays

The "send 1,000 generic emails and pray 2% respond" playbook is gasping its last breath. And honestly? Good.

When your outreach looks like this:

"Hi [FirstName],

I noticed [CompanyName] is committed to sustainability space. We help companies like yours achieve their climate goals.

Do you have 15 minutes next week?"

You're not prospecting. You're spamming.

The data is brutal: Studies show 58% of intro meetings bring zero value to prospects. Why? Because the salesperson did zero homework.

2. The "More Activity = More Pipeline" Myth

Here's what 2025 outbound statistics reveal:

- Sales reps spend only 28% of their week actually selling

- 42% say they don't have enough information before making a call

- It now takes 4.81 touches to get a response (up from 3.5 touches in 2020)

The problem isn't insufficient activity. It's insufficient intelligence.

Sending more emails without better context is like shouting louder when someone doesn't speak your language. Volume doesn't fix relevance.

3. Generic Playbooks in Specialized Markets

This is where the "outbound is dead" crowd really misses the mark.

Yes, generic SaaS outbound is struggling. When you're selling project management software, your prospects look similar, their pain points overlap, and at-scale personalization is possible.

But in specialized B2B markets like carbon credits, sustainability services, or climate tech? The game is completely different.

The Carbon Credits Paradox: Where Outbound Actually Works

Here's what makes carbon market sales unique—and why conventional outbound wisdom fails:

The Complexity Tax

Selling carbon credits isn't like selling CRM software. Your prospects need you to understand:

✓ Their specific climate commitments – Are they targeting net-zero by 2030 or 2050? Science-Based Targets or voluntary goals?

✓ Their current carbon activity – Have they retired credits before? Through which registries? What types of projects?

✓ Their sustainability maturity – Are they just starting their carbon journey, or sophisticated buyers seeking removal credits?

✓ Regulatory context – Are they in the EU ETS? Subject to CSRD reporting? In a jurisdiction with carbon tax?

✓ Verification standards – Do they require Verra? Gold Standard? Puro? Do they care about additionality claims?

This isn't information you find in LinkedIn Sales Navigator or Apollo.

This level of research takes hours per prospect—which is why most carbon credit sellers either:

- Skip the research and send generic emails (2-3% response rate)

- Do manual research and only reach 5-10 prospects per week

- Give up on outbound entirely and wait for inbound

What Winners Are Doing Differently

The carbon project developers and brokers booking 20+ meetings monthly aren't sending more emails. They're doing something radically different:

They're treating research as their competitive moat.

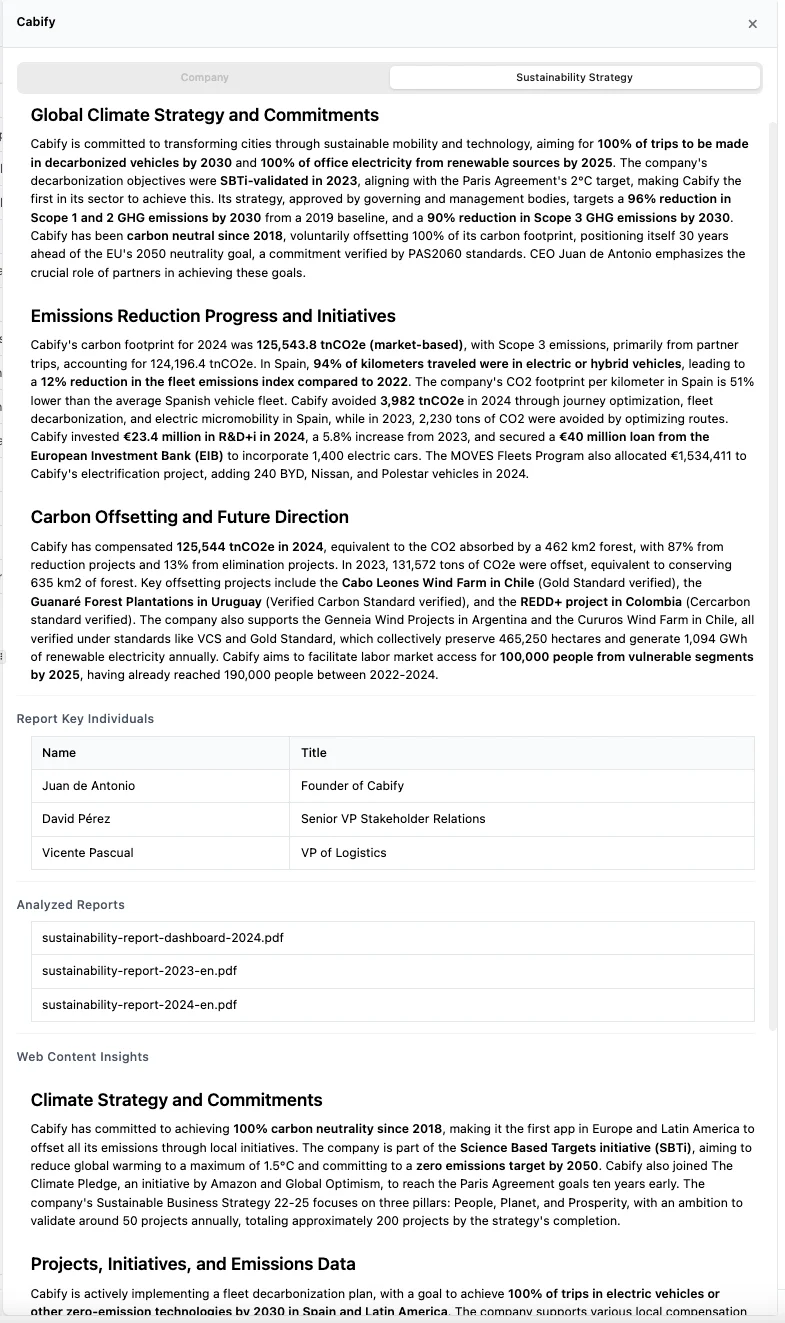

Here's a real example from our beta users:

Before:

- 40+ hours researching 100 prospects manually

- Crawling through Verra registry, Gold Standard databases

- Reading 50-page ESG reports for hints of carbon budget

- Trying to guess who handles carbon procurement

- 8% meeting acceptance rate

After implementing research automation:

- 2-3 hours for same 100 prospects

- AI analyzes registry retirements, sustainability disclosures automatically

- Identifies sustainability leads by analyzing hiring patterns, LinkedIn posts, report authorship

- 22% meeting acceptance rate

The difference? They stopped trying to scale volume. They scaled intelligence.

The New Outbound Equation for Specialized Markets

If generic outbound is dying, what's replacing it?

Outbound 2.0 = Deep Vertical Intelligence × Precision Targeting × Genuine Personalization

Let's break down each component:

1. Deep Vertical Intelligence

In carbon markets, this means knowing:

Company-Level Signals:

- Credit retirement history (volumes, types, vintages)

- Public climate commitments and deadlines

- ESG/CSR report contents and carbon strategies

- Sustainability team size and growth patterns

- Participation in voluntary initiatives (SBTi, RE100, etc.)

Contact-Level Signals:

- Role changes (new Head of Sustainability = buying window)

- LinkedIn activity on climate topics

- Speaking at sustainability conferences

- Publishing climate-related thought leadership

- Budget ownership signals

This data doesn't exist in traditional prospecting tools.

You can't buy a list of "companies planning to purchase carbon credits in Q2 2025" from ZoomInfo. You have to build this intelligence yourself—or use specialized tools that do.

2. Precision Targeting

Volume is out. Precision is in.

2020 Playbook:

- Identify 5,000 companies in "sustainability" category

- Blast everyone with title containing "Sustainability" or "ESG"

- Hope 50 respond (1% response rate)

- Qualify the 50 down to 5 opportunities

2025 Playbook:

- Identify 200 companies with specific carbon buying signals

- Research each company's carbon strategy depth

- Identify 3-5 decision-makers per company (sustainability lead + procurement + finance)

- Send tailored research-backed outreach to 500 highly qualified contacts

- Book 25-50 meetings (5-10% response rate)

Same effort. 10x better outcomes.

3. Genuine Personalization

Here's where most AI outbound tools fail spectacularly.

Bad AI personalization:

"Hi Sarah, I saw [CompanyName] posted about sustainability on LinkedIn and thought you might be interested in our carbon credits..."

Research-backed personalization:

"Hi Sarah, I noticed [Company] retired 50,000 credits through Verra's VCS program in Q3, primarily forestry projects in the Amazon region.

Given your recent LinkedIn post about increasing focus on high-integrity removal credits, I thought you might be interested in our portfolio of biochar projects offering permanent removals with Gold Standard certification.

Your Q3 ESG report mentioned plans to double offset volumes by 2025. Happy to share how we're helping similar buyers scale their programs while maintaining integrity standards."

The difference?

The second shows you've done your homework. You've read their filings. You understand their strategy. You're not wasting their time.

The Data That Proves Specialized Outbound Works

While generic outbound struggles, targeted outbound in complex B2B markets tells a different story:

Response Rates:

- Generic cold email: 1-2% response rate

- Personalized cold email: 32% higher response rate than generic (industry average)

- Carbon-specific research-backed outreach: 15-25% response rate (our beta data)

Meeting Quality:

- 58% of intro meetings bring no value to prospects (industry average)

- Research-backed meetings: 78% advance to second conversation (our beta data)

Time Allocation:

- Generic approach: 30% research, 70% sending emails

- Specialized approach: 80% research quality, 20% sending—but 3x the meeting rate

The Economics:

- Traditional SDR: 40 hours → 100 outreach → 3-5 meetings → 1-2 qualified opps

- Research-automated SDR: 40 hours → 500 research-backed outreach → 50-75 meetings → 15-20 qualified opps

Why Carbon Markets Demand a Different Approach

Still not convinced specialized outbound works? Consider the unique challenges of carbon market sales:

Challenge 1: The Credibility Crisis

The voluntary carbon market faced massive credibility challenges in 2023-2024:

- High-profile investigations questioned credit integrity

- Major buyers (Delta, Gucci, others) faced greenwashing lawsuits

- Verra credits came under scrutiny

- Market prices fluctuated wildly

What this means for outbound:

Generic "we sell carbon credits" pitches trigger immediate skepticism. Buyers need to know you understand quality standards, additionality, permanence, and verification rigor.

Your outreach must demonstrate depth:

- Reference specific registry standards you work with

- Acknowledge industry concerns about integrity

- Show you track their own carbon program maturity level

Challenge 2: Complex Buying Committees

Carbon credit purchases rarely involve just one person:

Typical buying committee:

- Sustainability Lead (identifies need, defines strategy)

- Procurement (negotiates pricing, terms)

- Finance (approves budget, ROI analysis)

- Legal (reviews contracts, liability)

- Communications (evaluates reputational risk)

Generic outbound reaches one person. Strategic outbound maps the committee.

Challenge 3: Long Sales Cycles with Specific Timing

Carbon credit sales have natural timing patterns:

- Q4 rush as companies try to hit annual targets

- Budget planning cycles (Q3-Q4 for next year)

- Post-earnings when climate commitments get renewed attention

- After regulatory changes or industry announcements

Spray-and-pray outbound misses these windows.

Research-backed outbound identifies:

- Companies approaching their commitment deadlines

- Recent sustainability hires (90-day onboarding period = research phase)

- New climate commitments announced in earnings calls

- Expansion of sustainability teams (budget signal)

Challenge 4: Market Fragmentation

Not all carbon credits are created equal:

Project Types: Forestry, renewable energy, cookstoves, direct air capture, biochar, regenerative agriculture, blue carbon...

Registry Standards: Verra VCS, Gold Standard, ACR, CAR, Plan Vivo, Puro.earth...

Credit Characteristics: Avoidance vs. removal, permanence, co-benefits, vintage, geography...

Buyer Preferences: Some want only removal credits. Others need co-benefits. Some require specific geographies.**

Generic outbound can't navigate this complexity.

You need to know:

- What types of credits this buyer has purchased before

- What standards they trust

- What their sustainability report says about credit preferences

- What their climate strategy prioritizes

The Future: Research as a Service

Here's what the next generation of outbound looks like in specialized markets:

Old Model: More Emails

- Buy a list of 10,000 "sustainability" contacts

- Blast them all with generic templates

- Hope 50 respond

- Manually research those 50

- Qualify down to 5 opportunities

New Model: More Intelligence

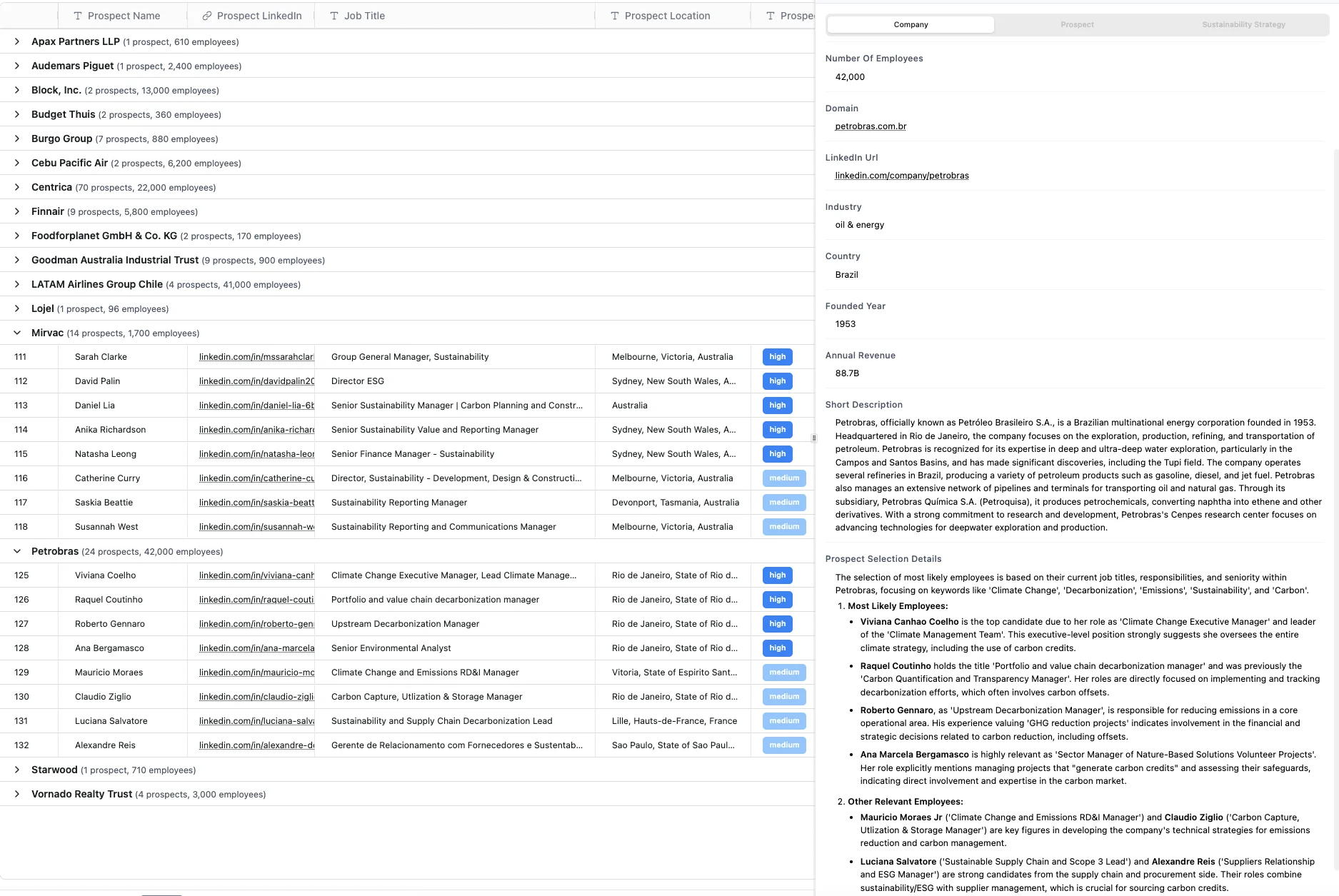

- Identify 500 companies with specific carbon buying signals

- AI analyzes registries, reports, hiring patterns, disclosures

- Surfaces the 100 most likely buyers based on maturity + timing + fit

- Provides research summaries on each company and contact

- BDR sends 100 deeply researched emails

- Books 15-20 meetings with pre-qualified, ready buyers

The bottleneck isn't BDR capacity. It's research quality.

What This Means for Your Carbon Market Sales Strategy

If you're selling carbon credits, offsets, or sustainability services, here's your playbook:

1. Stop Competing on Volume

You're not going to out-email generic AI SDRs. Don't try.

Instead, make research your competitive advantage. The deeper you understand each prospect, the less competition you face.

2. Treat Research as Core to Your Sales Motion

Research isn't something SDRs do before "real" sales work. Research IS the sales work in specialized markets.

Allocate resources accordingly:

- Traditional approach: 1 SDR researching + outreaching = 8 meetings/month

- Research-first approach: 1 SDR with automated research = 25 meetings/month

3. Build (or Buy) Carbon-Specific Intelligence

You need data that doesn't exist in traditional sales tools:

- Credit retirement tracking

- Sustainability disclosure analysis

- Climate commitment monitoring

- Sustainability team growth tracking

- Carbon-specific intent signals

Build this internally (expensive, slow) or use specialized tools (Emitree, cough).

4. Quality Over Quantity in Every Metric

Redefine success metrics:

-

❌ Emails sent per day

-

✅ Research depth per prospect

-

❌ Activity volume

-

✅ Meeting acceptance rate

-

❌ Opportunities created

-

✅ Qualified pipeline generated

5. Embrace AI for Intelligence, Not Just Automation

AI SDRs that just automate email sending make the problem worse.

AI tools that automate research and analysis make outbound actually work:

- Analyzing hundreds of ESG reports to identify carbon budget language

- Monitoring registry databases for retirement patterns

- Tracking sustainability hiring trends across industries

- Identifying buying signals from LinkedIn activity, job postings, report mentions

The Bottom Line: Outbound Evolved, It Didn't Die

Here's what actually happened:

What died: Generic, volume-based, spray-and-pray outbound to loosely targeted lists

What's thriving: Research-intensive, precision-targeted, vertically-specialized outbound to deeply qualified prospects

The carbon market reality:

- Market complexity INCREASES the value of good outbound (buyers can't easily find right sellers)

- Credibility concerns INCREASE the importance of demonstrated expertise

- Long sales cycles REWARD persistent, intelligent follow-up

- Committee buying DEMANDS multi-threaded, research-backed approaches

The companies winning in carbon market sales aren't sending more emails.

They're sending better-researched emails to better-qualified prospects based on better market intelligence.

That's not outbound dying. That's outbound evolving.

Ready to Evolve Your Carbon Market Prospecting?

If you're spending 30-40 hours per week manually researching carbon market prospects—crawling through Verra registries, reading sustainability reports, trying to identify the right contacts—there's a better way.

Emitree automates the research-intensive prospecting workflow specifically for carbon markets:

✓ Analyze credit retirements across all major registries (Verra, Gold Standard, ACR, CAR)

✓ Parse sustainability disclosures to understand climate strategies and carbon budgets

✓ Identify decision-makers with sustainability, procurement, and finance responsibilities

✓ Track intent signals like team growth, commitment announcements, and buying patterns

✓ Generate research summaries with specific hooks for personalized outreach

Result: 84% less research time. 2.5x more meetings booked. 300% pipeline growth.

Transform 40 hours of manual research into 2-3 hours of AI-powered intelligence—and spend the time you save having actual conversations with qualified carbon buyers.

Because outbound isn't dead. You just need to do it right.