Why Your HubSpot Lead Scoring Misses the Best Carbon Credit Buyers

Estimated reading time: 9 minutes

If you're selling carbon credits, sustainability services, or ESG solutions, you've probably invested in HubSpot's buyer intent and lead scoring features. You're tracking website visitors, scoring leads based on engagement, and prioritizing accounts that download your whitepapers or visit your pricing page.

But here's the problem: the companies showing the strongest buying signals for carbon credits and sustainability services rarely show up as high-scoring leads in HubSpot.

Why? Because HubSpot—like most B2B marketing automation platforms—was built for generic B2B sales. It excels at tracking behavioral engagement and firmographic fit, but it's completely blind to the sustainability-specific signals that actually predict purchasing readiness in carbon markets.

Let's break down what HubSpot does well, where it falls short for sustainability markets, and how you can augment it with specialized sustainability intelligence to find the buyers who actually have budget, urgency, and authority.

What HubSpot's Buyer Intent and Lead Scoring Actually Track

Before we dive into the gap, let's establish what HubSpot is designed to capture.

Buyer Intent (powered by HubSpot's Breeze Intelligence) uses reverse-IP lookup technology to identify which companies are visiting your website—even if they don't fill out a form. When someone from a company that matches your target market visits high-intent pages like pricing or case studies multiple times within a defined timeframe, HubSpot flags them as "Showing Intent."

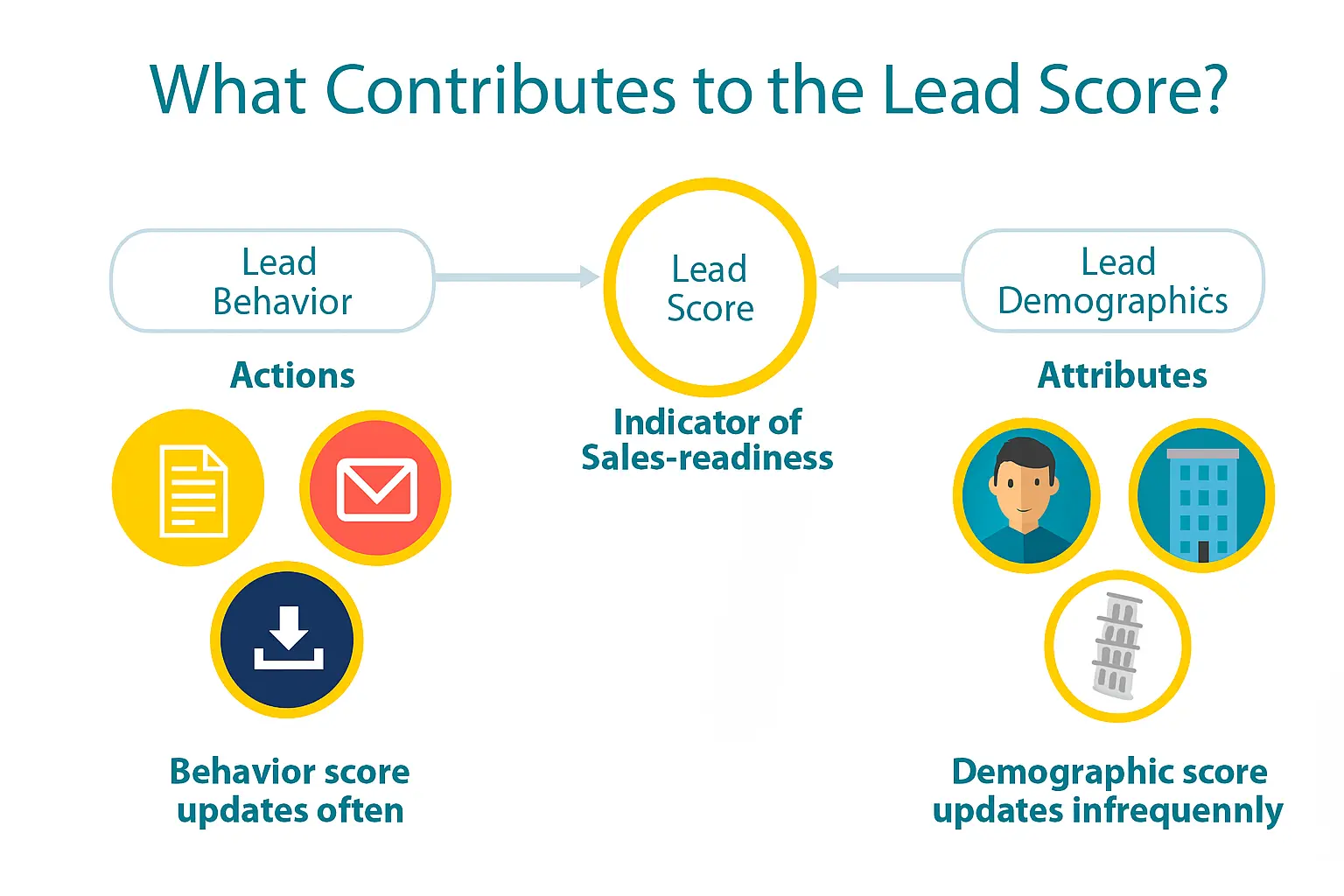

Lead Scoring assigns point values to attributes and behaviors that indicate sales-readiness. Companies typically score leads based on:

Fit Criteria (Demographics/Firmographics):

- Company size and revenue

- Industry and sector

- Job title and seniority

- Geographic location

Engagement Criteria (Behavioral Data):

- Website page views and visit frequency

- Email opens and click-throughs

- Content downloads (whitepapers, case studies)

- Form submissions and demo requests

- Webinar attendance

HubSpot's predictive lead scoring uses AI to analyze your historical customer data and predict which leads are most likely to close within 90 days based on patterns in your past conversions.

For most B2B companies, this works beautifully. A SaaS company selling project management software can reasonably assume that a Director of Operations at a 500-person company who visits their pricing page five times and downloads a case study is a hot lead.

The Sustainability Market Gap: What HubSpot Can't See

But carbon credit and sustainability markets operate fundamentally differently. Here's what HubSpot's traditional scoring approach misses:

The High-Scoring Lead Who Will Never Buy

HubSpot sees:

- Large manufacturing company (2,000 employees) ✓

- Carbon-intensive industry ✓

- Multiple website visits over 30 days ✓

- Downloaded sustainability whitepaper ✓

- Opened 5 marketing emails ✓

- HubSpot Score: 85/100 (High Priority)

What HubSpot doesn't see:

- No sustainability commitments or targets

- No carbon credit purchase history

- Already achieved CDP A-List status (sophisticated program, not in market)

- Competitor conducting market research

- University researcher gathering information for academic paper

Result: Your SDR spends hours researching and crafting outreach to a prospect with zero buying intent, wasting valuable time on a lead that scores high but will never convert.

The Low-Scoring Lead Who Needs to Buy Right Now

HubSpot sees:

- Mid-sized company (800 employees)

- First website visit (no engagement history)

- No email opens

- HubSpot Score: 25/100 (Low Priority)

What HubSpot doesn't see:

- Committed to Science-Based Targets 3 months ago (must submit validated targets within 21 months)

- Published first ESG report last quarter (maturity inflection point)

- Hired Chief Sustainability Officer 60 days ago (new budget authority)

- Largest customer issued supplier sustainability mandate (30% of revenue at stake)

- Made first carbon credit purchase last month (100 VCUs on Verra registry)

- Faces EU CSRD compliance deadline in 18 months

Result: This company has urgent, time-bound needs, budget allocation, decision-maker in place, and external pressure to act—but they languish in your low-priority nurture sequence because they haven't engaged with enough content yet.

Why This Gap Exists

Traditional lead scoring answers: "Is this company a good fit and are they engaged with our content?"

Sustainability markets require answering: "Does this company have active commitments, regulatory obligations, or external mandates creating time-bound purchasing needs?"

The buying triggers in sustainability markets are:

- Commitment-driven deadlines (SBTi 24-month validation timeline, net-zero interim targets)

- Regulatory compliance windows (EU CSRD phased implementation, SEC climate disclosure)

- Supply chain cascade effects (customer mandates requiring immediate supplier action)

- Organizational changes (new CSO hire indicates budget allocation and program buildout)

- Carbon market activity (first credit purchase signals procurement infrastructure established)

None of these signals live in HubSpot. They exist in carbon registries (Verra, Gold Standard), commitment databases (Science-Based Targets initiative, CDP), public ESG reports, regulatory filings, and hiring platforms—sources that generic marketing automation tools simply don't integrate.

What Sustainability-Specific Intelligence Looks Like

Here are the data points that actually predict carbon credit buying readiness—none of which HubSpot captures:

Carbon Registry Transaction Data:

- Companies purchasing and retiring carbon credits on Verra, Gold Standard, American Carbon Registry

- Purchase volumes, frequencies, and project types

- First-time buyers (new to market, building programs)

- Companies increasing volumes (expanding commitments)

Commitment and Target Databases:

- Science-Based Targets initiative: 10,000+ companies with validated targets or commitments, each with a 24-month submission deadline creating a defined procurement window

- Net-Zero Tracker: 4,000+ entities with net-zero pledges, target years, and quality markers

- CDP Disclosure: 23,000+ companies reporting emissions, with scores indicating maturity level

- RE100: 400+ companies committed to 100% renewable electricity

Sustainability Leadership Hiring:

- Chief Sustainability Officer and VP Sustainability appointments

- Carbon Accounting Manager and ESG Analyst roles

- Hiring indicates budget allocation and 6-12 month implementation timelines

Regulatory and Compliance Triggers:

- EU CSRD phased implementation (50,000 companies affected)

- SEC climate disclosure requirements

- Supply chain mandates from major customers (CDP Supply Chain program involves 270+ requesting companies)

ESG Report Publications:

- First-time ESG reports signal program initiation

- Report quality and scope indicate maturity level

- Commitment announcements reveal timelines

This data is publicly available and constantly updated—but it's fragmented across specialized sources that require active monitoring and analysis to turn into actionable sales intelligence.

How Emitree Augments HubSpot's Lead Scoring

Rather than replacing HubSpot, Emitree adds a critical layer of sustainability-specific intelligence that transforms how you qualify and prioritize inbound leads.

The Layered Approach:

Layer 1 - HubSpot provides:

- Website visitor identification (which companies are researching)

- Engagement tracking (how interested they appear)

- Firmographic fit scoring (do they match your ICP)

- Marketing automation and CRM workflow

Layer 2 - Emitree adds:

- Sustainability commitment status and urgency timelines

- Carbon market activity and purchasing patterns

- ESG leadership changes and hiring signals

- Regulatory compliance triggers and deadlines

- Supply chain mandate identification

Combined Scoring in Action:

Let's revisit that low-scoring lead from earlier—the 800-person company with minimal HubSpot engagement:

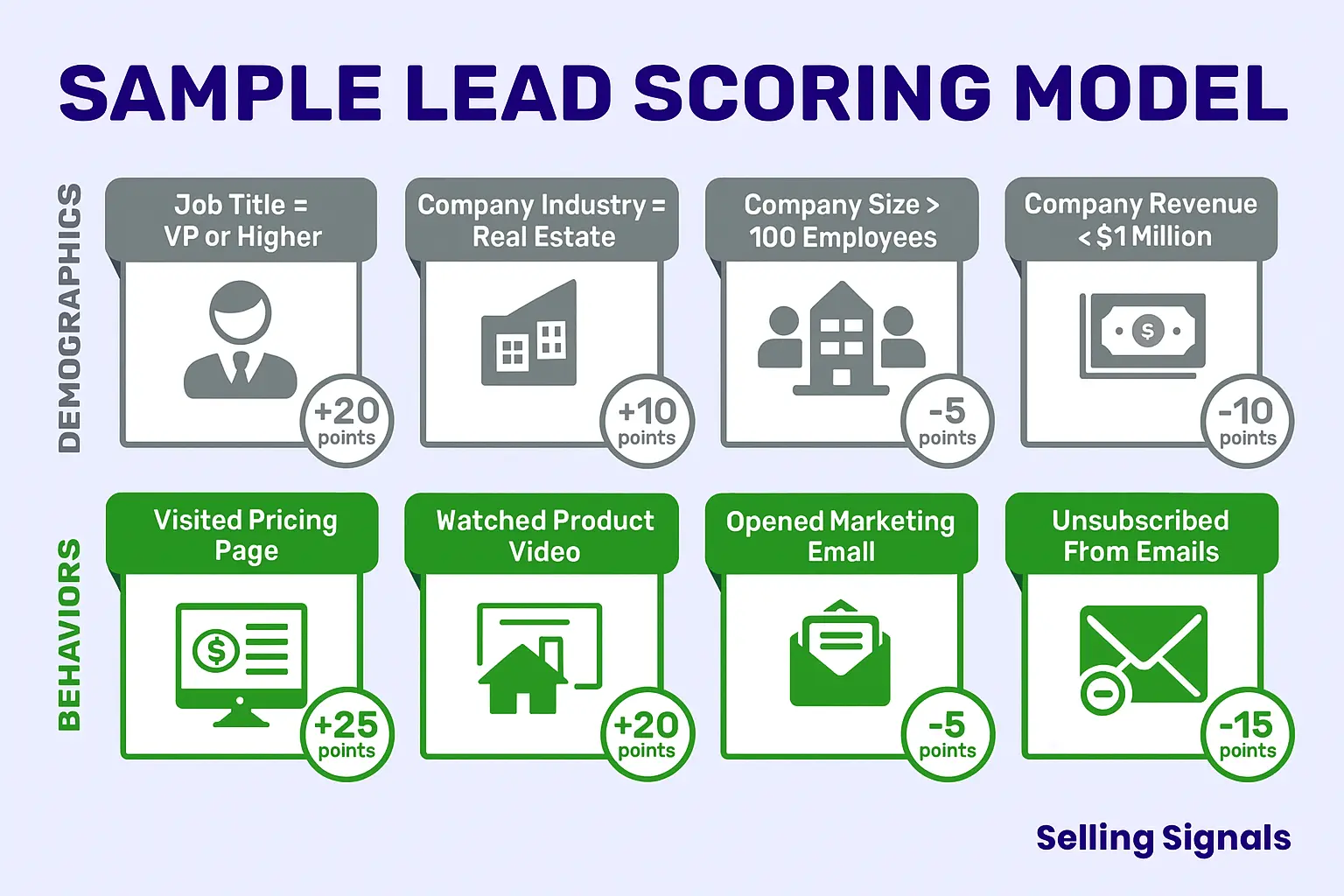

HubSpot base score:

- Company size match: +15 points

- Industry match: +10 points

- First website visit: +5 points

- HubSpot Total: 30/100

Emitree augmentation:

- SBTi commitment (3 months old, 21 months to deadline): +25 points

- First carbon credit purchase (30 days ago, 100 VCUs): +20 points

- CSO hired (60 days ago): +15 points

- CDP disclosure initiated (first-year reporter): +10 points

- EU CSRD compliance deadline (18 months): +15 points

- Customer mandate received: +10 points

- Combined Total: 125/150

Now your SDR knows this is an urgent, high-priority prospect with demonstrated commitment, budget allocation, decision-maker in place, and multiple external pressures creating immediate need—despite minimal website engagement.

Real-World Scenarios: Combined Intelligence at Work

Scenario 1: Early-Stage Buyer with Urgent Timeline

A manufacturing company visits your website twice, reads one blog post, and disappears. HubSpot scores them 35/100.

Emitree reveals they committed to SBTi 4 months ago, posted a job for "Manager, Environmental Sustainability" 45 days ago (still open), published their first ESG report 90 days ago, and their largest customer just announced supplier sustainability requirements.

Insight: Low engagement but high urgency. They're in active procurement phase, building team, under external pressure.

Action: Immediate high-touch outreach offering SBTi roadmap consulting and carbon accounting assessment, positioning as implementation partner for committed buyer.

Personalized outreach becomes possible:

"I noticed [Company] committed to Science-Based Targets in June and recently published your first ESG report—congratulations on these important steps. As you approach your SBTi submission deadline in mid-2026 and build your sustainability team, I wanted to share how we've helped similar manufacturing companies develop Scope 3 methodologies and reduction roadmaps..."

Scenario 2: Competitive Displacement Opportunity

A company shows strong engagement in HubSpot: 8 website visits over 60 days, multiple pricing page views, whitepaper download, form submission from Director of Sustainability. HubSpot scores them 85/100.

Emitree reveals they've had SBTi validated targets for 3 years, are a CDP A-List company for 5 consecutive years, purchase 2,500+ carbon credits annually, have an 8-person sustainability team—and their current provider's contract expires Q4.

Insight: Sophisticated buyer evaluating alternatives, competitive displacement opportunity.

Action: Position as premium alternative emphasizing innovation and optimization rather than basic education.

Personalized outreach becomes possible:

"As a CDP A-List company and early SBTi adopter, [Company] is clearly a climate leader. I noticed you're exploring advanced Scope 3 strategies, which aligns perfectly with our new supply chain engagement platform that's helped companies like [similar A-List company] reduce Scope 3 emissions 22% while maintaining supplier relationships..."

Scenario 3: Regulatory Compliance Driver

No website visits, one email open from general newsletter. UK-based financial services firm with 1,200 employees. HubSpot scores them 25/100.

Emitree reveals they're subject to mandatory TCFD reporting with FCA deadline in 6 months, just hired a "Head of Climate Risk" 30 days ago, have no CDP disclosure history, no SBTi commitment—but a competitor in their sector just announced major sustainability initiative.

Insight: Zero engagement but high urgency due to regulatory deadline and new leadership hire.

Action: Compliance-focused outreach emphasizing deadline support and rapid implementation.

Personalized outreach becomes possible:

"With the FCA's TCFD reporting deadline in May, I wanted to reach out given [Company's] recent hire of a Head of Climate Risk. We've helped 15 UK financial institutions navigate their first TCFD disclosure cycle, from climate scenario analysis to board reporting. Our accelerated 90-day implementation program is designed specifically for organizations starting their climate journey under regulatory deadlines..."

Implementation: Making This Work in Practice

The most effective approach combines HubSpot's engagement tracking with Emitree's sustainability intelligence through automated workflows:

- HubSpot identifies engagement: Companies visiting your website, downloading content, or responding to campaigns

- Emitree enrichment: Automatically layers sustainability data on those engaged companies

- Combined scoring: Prioritizes prospects with both engagement AND sustainability urgency

- Segmented outreach: Tailors messaging based on maturity level, commitment type, and timeline urgency

- Continuous monitoring: Emitree tracks changes in sustainability status (new commitments, hiring, carbon purchases) and updates HubSpot records

Custom HubSpot properties store Emitree data:

- Sustainability Urgency Score (0-100)

- SBTi Status and Deadline

- Carbon Purchase History

- Sustainability Leadership Hiring Status

- Regulatory Compliance Triggers

Workflows automatically route high-urgency prospects to senior reps, trigger personalized email sequences based on sustainability maturity, and surface key talking points for sales conversations.

The Bottom Line

HubSpot tells you who's interested. Emitree tells you who has urgent, time-bound needs backed by commitments and budgets.

Together, they identify the prospects who are both engaged AND have actual buying intent—eliminating the false positives (high engagement, no commitment) and false negatives (low engagement, urgent deadline) that plague sustainability sales teams relying on traditional lead scoring alone.

For carbon credit and sustainability service providers, this isn't a nice-to-have enhancement—it's the difference between chasing tire-kickers and closing deals with buyers who have allocated budgets, installed decision-makers, and regulatory or commitment-driven timelines forcing action.

The companies that integrate sustainability intelligence into their lead qualification process now will dominate pipeline development while competitors waste resources on leads that score high but never convert.

Ready to see which of your HubSpot leads have urgent sustainability commitments? Emitree's AI-powered prospecting platform automatically identifies companies with SBTi targets, carbon credit activity, ESG leadership hiring, and regulatory compliance deadlines—turning your inbound leads into prioritized, context-rich opportunities.